As a startup did you think of adapting to digitization?

If yes, do you have an idea for developing an application for your business?

You must be thinking that developing an application from a mobile app development company would be an expensive affair. However, hiring an in-house team or outsourcing an app development team still comes second.

Firstly, you need to find investors to fund your application. Do you have any idea on how to get investors for an app?

Don’t worry, we are here to explain to you detailed steps on how to find investors and how to convince them to fund your app.

Let’s start.

How to Get Investors for an App – Steps to Follow

We have written steps to follow to find the best investors who agree to fund your app idea.

Write down your idea and understand your niche

Today, everything is on mobile. If you are looking for something to start or purchase, there’s an app for it. This gives you a strong reason to understand what is your niche. Mobile app investors would not like to fund any such app that exists already.

Noting down your app idea from the beginning will assist you in planning and future development. It is actually much simpler to convey to app investors and later to hire mobile app developers when you have a document ready to develop.

If you want to comprehend the outcomes of your experiments, you need to put down your thoughts in sufficient depth. When you fully trace your workflow and document your idea, you can immediately determine what to do, why to do it, and when to do it.

You must conduct thorough research to better understand your app. Investors don’t want to support an abstract concept. They demand specifics regarding the target market, the issue being treated, the features your app offers, and a long list of other information. You must focus on your app idea in order for investors to feel safe making a purchase.

Market analysis and competitors

You can learn about current market trends, the preferences of your target market, and details about your competitors by conducting research for your mobile app. These are a few justifications for conducting a market analysis.

- Understand what information your audience is seeking.

- What is currently popular in your industry?

- What affects the target audience?

- Consumer attraction factors and pain areas.

- What are the pricing details for a certain service or commodity?

Create an MVP

Make an MVP of your mobile application.

You may get a sense of how it functions by creating a minimum viable product with only the most essential features. Furthermore, the investors will comprehend how the app functions. They have the ability to view and use tangible products in real time. Offering a condensed version of the ultimate fully-functional app enhances the likelihood that venture capital companies will fund your app idea.

The average price for developing an MVP app is between $100,000- $,150,000 depending on a number of variables, such as the project’s scope, the type of application, the technological stack, the developers’ fees, the use of third-party services, and the features and functionalities of the application. Find an app developer for a startup who can help you create MVP for your mobile app.

Search for an investor for a mobile app startup- Know how much fund is needed

If you are vouching for an answer to how to get investors for an app, you need to understand how much funding you need from an investor.

There are various funding stages that you need to be aware of. You will require more money as you progress through the stages of developing a mobile app. The project might not succeed if money is not raised in a timely manner. There is no such thing as average funding. But, the specific number will depend on your app’s concept, level of complexity, and intended use. The funding steps are shown in the graphic below.

An overview of Pre-seed, Series A, Series B, and Series C funding may be seen in the short table below.

Let’s examine each funding in further detail.

Pre-seed funding is frequently the initial round of funding. In exchange for stock, investors fund firms during this stage so they can create products. Most business owners in this position may just have a prototype and were unable to launch a product. Investors are harder to persuade as a result.

Businesses that apply for Series A funding must intend to create profitable apps in the long run. Investors seek out businesses that have both excellent ideas and a solid plan for developing those ideas into profitable ventures. The primary goal of the series A funding is to keep the company expanding and draw in more investors for the next round.

Series B financing is the second round of funding for a business that has achieved specific objectives and moved past the early startup phase. At this point, the business has attained stability, established processes, and a faultless app. Although app sales are beginning to rise, they might not be sufficient to dominate the market.

Applications that receive series C funding are considered successful. At this point, the brand is looking for additional money since it needs to grow, buy other businesses, and create new goods.

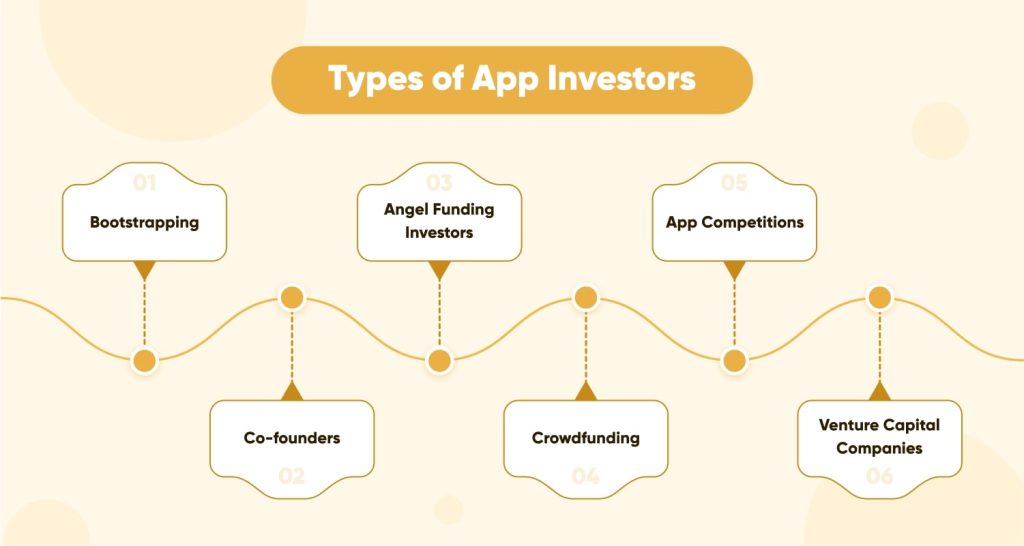

Different sources of investors you should know before searching for investors

You need to find the correct kind of investors now that you are aware of the amount of money needed for your mobile app. We have listed the numerous types of investors that are accessible on the market in the following area. You can choose the best source and sort of funds to acquire once you have a basic understanding of the investor’s listing.

Let’s explore the many app investors that might help you finance your mobile application.

6 Types of App Investors to Support the Development of Mobile Apps

You can raise money from six different sorts of investors, not just one. The many classes of potential investors are listed below.

Bootstrapping

Bootstrapping is another term for self-funding. This is the process of making investments using only personal savings, loans from personal friends and family, or capital from current personal investments.

Why is self-funding through bootstrapping one of the finest methods?

The business owner gains experience at the expense of personal savings. So, the business owner won’t be responsible for repaying loans or other borrowed money if the venture fails.

With bootstrapping, business owners may put their attention on company expansion and process improvement rather than fundraising.

Co-founders

Recruiting a member of your family to join you as a co-founder is another option for finding an investor. They might invest in your app project if they are sold on your app idea.

Why are co-founders among the most effective sources of funding?

The co-founder serves as a sounding board for all of your ideas while actively participating in decision-making.

You are protected from debt or bank loans, and you may easily get in touch with family members whenever you need to.

Angel Funding Investors

Angel funding is often referred to as seed funding. Comparatively speaking, angel funding is more adaptable and straightforward than other types of investment. Before you present your app idea to an angel investor, make sure you finish your research.

Crowdfunding

Go through a fundraising campaign based on one of the three financing types-donation-based, incentive-based, or investment-based. Entrepreneurs and investors can generate money for development projects by using websites like Kickstarter and Indiegogo.

Why is crowdfunding one of the finest methods for raising money?

Investors can follow your progress, which may aid in spreading the word about your company among their contacts.

If you’ve had trouble obtaining traditional funding or bank loans, this alternative finance option may be for you.

App Competitions

Worldwide, there are a lot of fundraising competitions. Shark Tank on TV is one of the well-known fundraising competitions. Thus, if you can, enter Shark Tank to try to secure funding for your software. But that is not what this is about. Several comparable competitions supported by colleges exist, and tech firms offer chances for entrepreneurs to pitch their ideas and persuade investors to fund them.

Venture capital companies

Venture investors contribute a sizable sum of money. It does require time, although this is not always the case. These investors are looking for a profitable program that runs quickly.

Why is investing in a venture capital firm one of the greatest options?

The venture capitalists are not owed anything. Moreover, venture capital companies provide funds at no interest.

Venture capitalists are beneficial in that they provide a large network for the business and don’t require security.

Branding

Do you know the best pointer to remember on “how to get investors for an app?”

Investors can tell that you are serious about your app idea and have given it a lot of thought by looking at your logo or domain for it. Instead of keeping your idea vague, branding aids investors in visualizing it.

Any company’s branding is its foundation; if in doubt, turn to the brand. The branding of your app idea will serve as the framework for the remainder of the development process, therefore this is also true. Brand your app, whether it be with a domain, a prototype of a website, or a mockup of the app, so investors can see your idea and better comprehend what you’re proposing to them.

You may like this: Building a Two-Sided Marketplace for Your Business

Create a convincing pitch

Do not anticipate that investors will learn about your original business concepts and provide an early investment in your new mobile app. Your goal is to immediately pique the investors’ interest so that you may take the conversation further. You must learn how to pitch an app idea if you want to succeed in that endeavor.

One of the best examples to comprehend the pitch meeting is Planet of the Apps. The contestants have only 60 seconds to present their app concepts. Make sure your investors understand the issue you hope to address with the features you plan to use when you pitch an app idea.

What should be in a pitch deck?

You can include the following points in your pitch deck.

- Declare your identity and the reason you are here.

- Determine the issues, the market’s size, the competitors, and the objectives.

- Provide a simple, understandable solution with features for investors.

- Display your company’s brand, MVP, and the service you’re offering.

- Make it clear to them that you are financially capable of achieving your objectives.

- Finally, explain to investors what you require of them and why.

How to get investors for an app- Find the Right One

Lack of funds or poor app development strategy may lead to causes of app failure. Yet, you may find the best investors for your mobile application with the correct methods and timely executed strategies.

You just need to sell your app idea to investors and demonstrate that it has the potential to succeed in the market. Keep in mind that developing an app is a one-time effort, but you may add new features to draw in new users.

Take a look at

Frequently Asked Questions

-

There are several sources to find investors for your app. You can either choose crowdfunding, angel investors, family, and friends, or venture capitalists for your business funds.

-

There are multiple ways to get funding for an app finding a reliable source to fund, starting a crowdfunding campaign, raising funds, taking part in app contests, or focusing on angel investors.

-

You can immediately look for how to get investors for an app and also search the market niche. Find out how many competitors are already running in the market with the same app idea. Come out with a unique idea, and create a pitch to get the investors convinced.

-

Finding an investor is not an easy job. It takes a lot of factors like app idea, how much much do you need as funds, which source is the best for your app or business, and post to everything, which mobile app development company will help you develop an app with the given funds. You can read our blog to find out how to find investors for an app and also reach out to us for app development.

-

It depends on the app idea and how big is the industry. However, before you select the type of investor you need to ensure what capital is required.